What is better than a bear market to test our convictions: does crypto truly have adoption across various markets or are we all lying to ourselves? This is the question I will answer in this article. Before we go further, I would love to hear about evidence of adoption or lack thereof you see in the market. Leave your thoughts in the comments section below.

Second Time Bear Market. Anything Different This Time?

I have to admit this is my second cycle but a 75% drawdown still shakes me to my core. As such let’s take stock of our current market cycle, not in terms of BTC or ETH prices, but of the adoption level we have achieved so far (or lack there of) and what it informs us of crypto’s future.

Of course there are many lens through which to view crypto: photography NFTs and DeFi options market etc. But to answer whether crypto has any sort of adoption, we need to gain a high level view. Therefore I shall focus on the overall crypto market (BTC/ETH) to start off with and then divide into the biggest verticals that most of you have heard of, namely DeFi and NFTs.

Bitcoin + Ethereum Network Usage

According to onchain data analytics provider Glassnode, both, the number of active BTC addresses and the number of addresses holding over 0.1+ BTC, are showing an upward trend in terms of more people joining the Bitcoin network.

The same is true for Ethereum. The number of ETH addresses holding at least 0.1eth has more than 2X’ed from the 2018-2019 bottom. While the 30 day Moving Average of the active addresses interacting daily with Ethereum has also 2X’ed compared to 2018-2019 bear market. The protocol revenue (after the EIP1559 implementation since Aug 2021), is still around $43mil a month accruing to ETH stakers. Given the most crypto activities are happening on L1 chains, this show more and more people are becoming crypto native.

Ethereum Decentralized Finance (DeFi) Activities

Going one level deeper we can see the resilience of the two biggest DeFi verticals within Ethereum ecosystem, namely DEX trading and borrowing/lending markets. While Uniswap dominates the DEX vertical, Compound and Aave lead the lending market.

To get a sense of the usage of these protocols, let’s dive into their trading activity and fee/revenue data. For Uniswap, we can see it is continuing to generate significant volume and trading fees. Although the activity level has come down from the 2021 DeFi summer high by around 50%, it is still up 2x+ from May 2021.

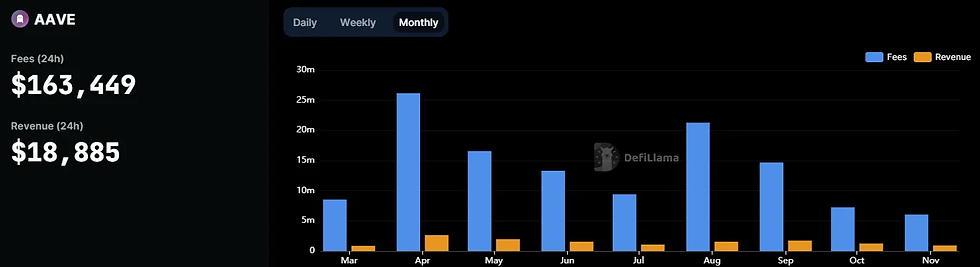

For Aave and Compound, both protocols have seen dramatic user fees fall from 2021 DeFi summer level indicating a depressed risk appetite in the market. But both protocols are still generating revenue and there are fee paying users in millions of dollars. It probably speaks to the seasonality of the lending/borrowing vertical. This cyclicality is similar to the way credit underwriting and loan origination activity of commercial banks ebbing with the credit/economic cycle in traditional finance.

Ethereum Non-Fungible Token (NFT) Activities

Likewise the trough to trough number for NFT market tells a similar story of resilient adoption. NFT trading across different platforms remains resilient. We still have over 300k ETH worth of volume in this bear market or around $360mil a month across various NFT platforms. This is an 15x higher than Nov 2020 volume in ETH terms (20k ETH) and even more in USD terms as ETHUSD price was around $400 2 years ago. Even more positive is the number of unique users (measured by wallets) interacting across these platforms. 200k+ vs a few thousand 2 years ago.

While sentiment is tepid and generally negative, the activity data onchain demonstrate clearly that although we are down bad from the peak in the cycle, we are nevertheless up big from the depth of bear of the last cycle. Of course a significant portion of tourists leaves in every cycle. Yet more and more people are being onboarded to the crypto world through BTC + ETH and are becoming crypto native through their everyday DeFi and NFTs activities. We are still early and it looks like there is a huge market to onboard. Keep learning and building frens.

What got you interested in crypto? What crypto applications do you use or want to learn about? Leave your comments below.

Comments